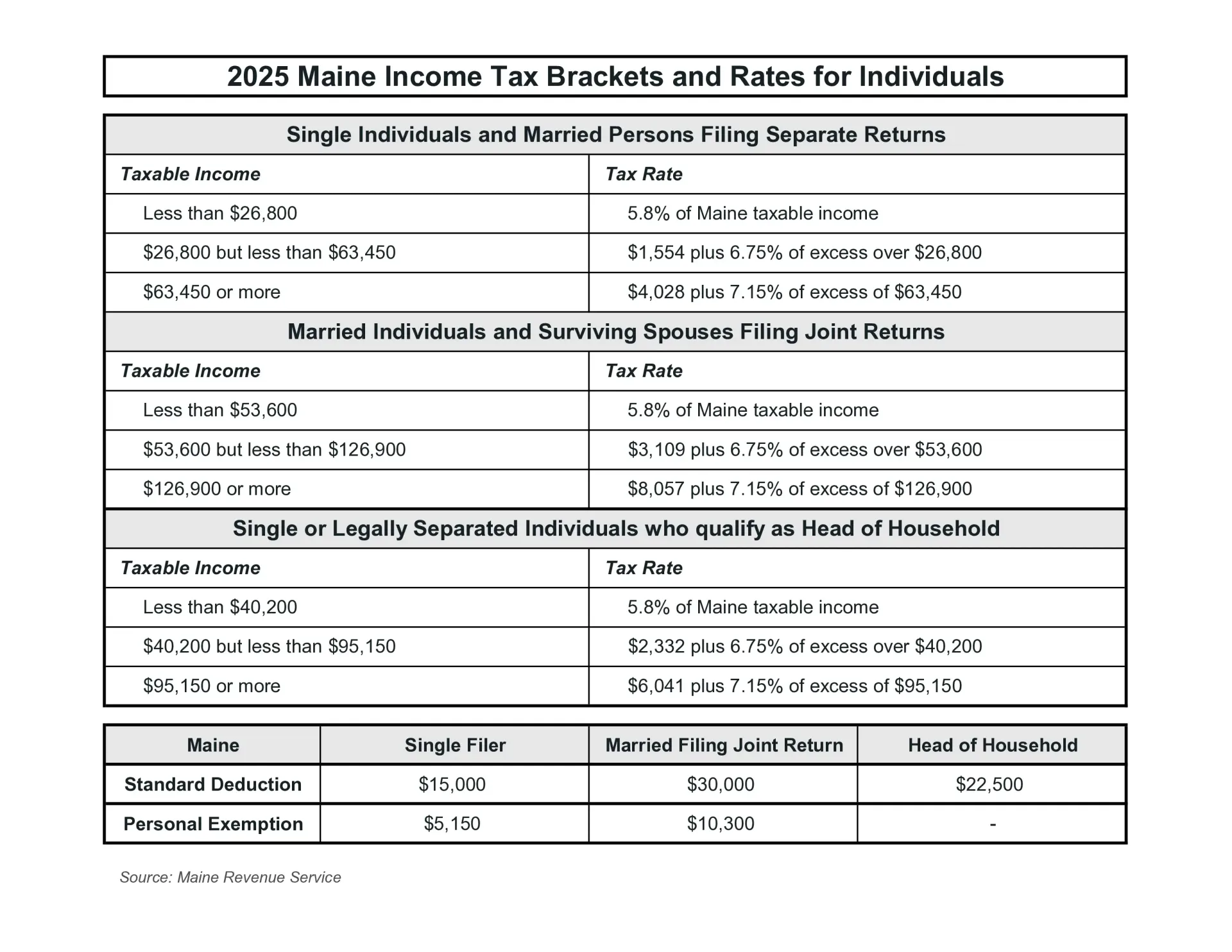

2025 Maine Tax Brackets

- Deduction and/or exemption tied to federal tax system. Federal deductions and exemptions are indexed for inflation.

- Maine's personal exemption begins to phase out for taxpayers with income exceeding $286,200 for single filers or $343,400 for those married filing joint returns (2025 inflation adjustments). The dependent personal exemption is structured as a tax credit and begins to phase out for taxpayers with income exceeding $200,000 as head of household or $400,000 when married filing jointly.

- Bracket levels adjusted for inflation each year. Inflation-adjusted bracket levels for 2025 are shown.

Click on the links above for further information